Mastering Trading Economics: A Path To Financial Success

In today's fast-paced world, understanding the intricacies of trading economics is vital for anyone looking to make informed financial decisions. With global markets becoming increasingly interconnected, the ability to analyze economic data and trends has never been more crucial. Trading economics provides valuable insights into how economies function, offering a roadmap for investors, policymakers, and traders alike.

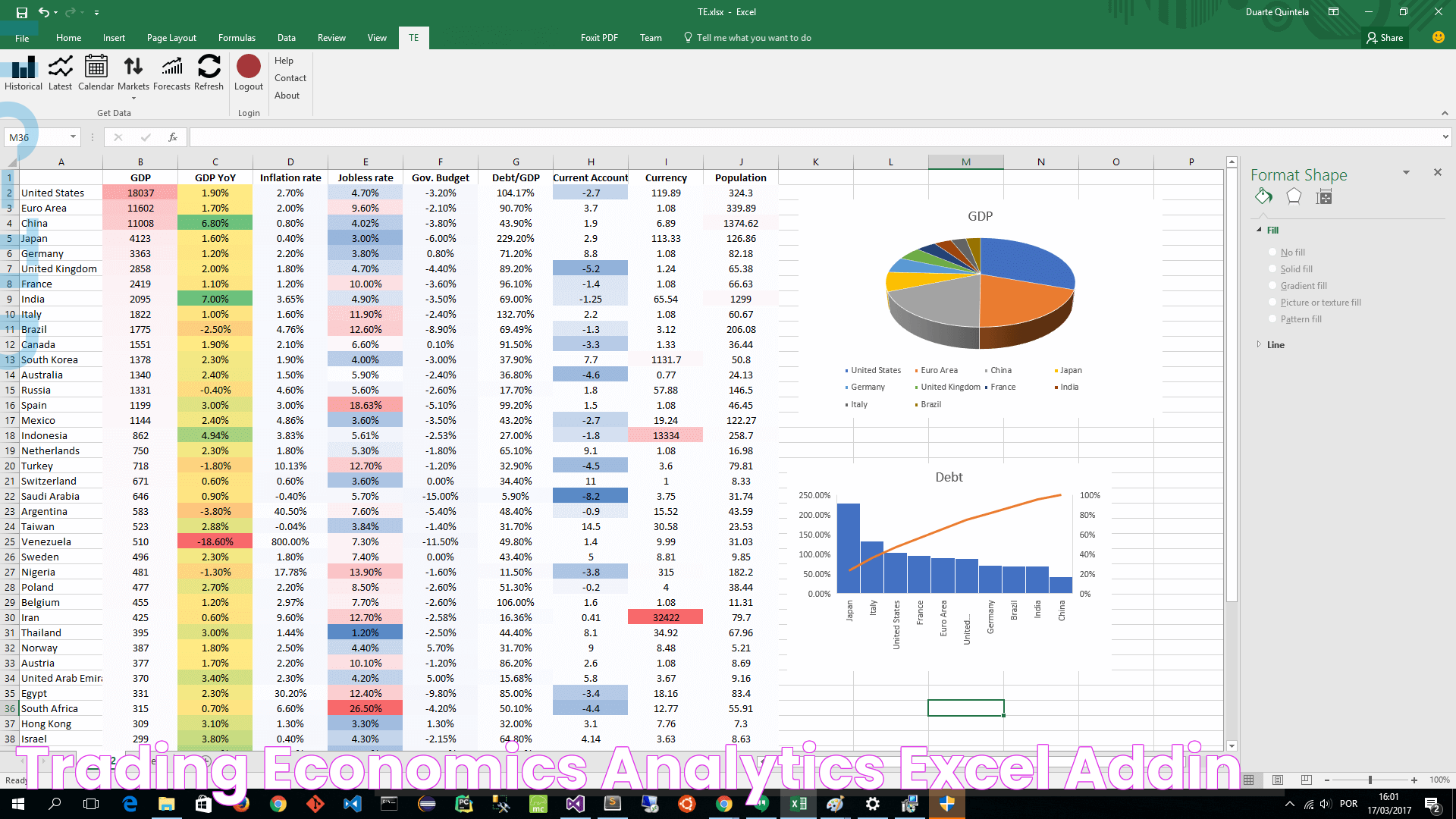

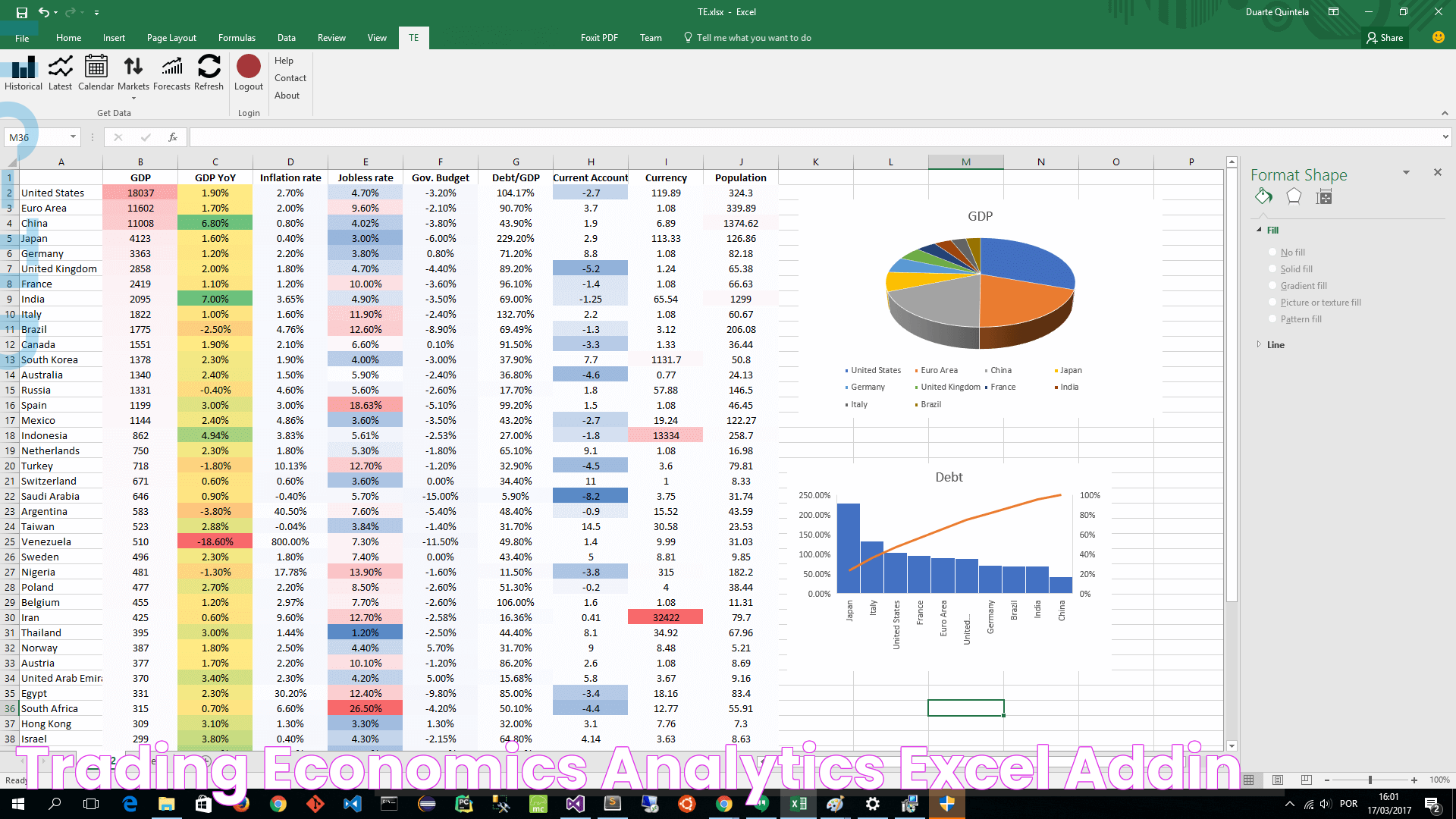

Trading economics involves the study of various economic indicators, such as GDP, inflation rates, and employment statistics, to understand their impact on financial markets. By examining these indicators, individuals can make more informed decisions on investments, currency trading, and asset allocation. This comprehensive approach helps to navigate the complexities of the global economy, ensuring that one can capitalize on opportunities while mitigating risks.

For those new to the concept, trading economics may seem daunting. However, with the right tools and knowledge, it becomes an essential skill that enhances one's financial literacy and investment acumen. By mastering trading economics, individuals can gain a deeper understanding of market dynamics, enabling them to make strategic decisions that align with their financial goals. This article delves into the core elements of trading economics, providing a detailed guide for aspiring traders and investors.

Read also:Introduction To Maplestar Jujutsukaisen And Its Intriguing World

Table of Contents

- What is Trading Economics?

- The Importance of Trading Economics

- Key Economic Indicators

- How Do Economic Indicators Affect Markets?

- Using Trading Economics for Investment Decisions

- The Role of Technology in Trading Economics

- Common Mistakes in Trading Economics

- Trading Economics Strategies

- How to Get Started with Trading Economics?

- Understanding Global Economic Cycles

- Trading Economics and Risk Management

- How Does Trading Economics Influence Policy Making?

- Impact of Geopolitical Events on Trading Economics

- Trading Economics and the Future

- Frequently Asked Questions

- Conclusion

What is Trading Economics?

Trading economics is the comprehensive analysis and study of economic data and its effects on financial markets. It focuses on understanding the relationships between different economic indicators and how they influence market dynamics. This field encompasses a wide range of topics, including macroeconomic trends, microeconomic factors, and global economic cycles. By tracking these elements, traders and investors can make informed decisions that align with their financial objectives.

The foundation of trading economics lies in the collection and interpretation of economic data. This data includes everything from gross domestic product (GDP) figures to unemployment rates and consumer price indices. By analyzing these indicators, individuals can gain insights into the health of an economy and predict potential market movements.

Core Components of Trading Economics

- Macroeconomics: Examines large-scale economic factors, such as national productivity and interest rates.

- Microeconomics: Focuses on individual and business-level economic activities and their impact on market trends.

- Data Analysis: Utilizes statistical tools and methods to interpret economic data and forecast future trends.

Trading economics is essential for anyone involved in financial markets, whether they are investors, traders, or policymakers. By understanding the underlying economic factors that drive market behavior, individuals can make more strategic and informed decisions.

The Importance of Trading Economics

Trading economics plays a crucial role in the world of finance by providing valuable insights into market trends and economic conditions. It allows investors and traders to stay ahead of the curve by anticipating market movements and making informed decisions. Understanding trading economics is not just about knowing numbers; it's about comprehending the stories those numbers tell about the economy.

One of the key benefits of trading economics is its ability to provide a comprehensive view of the economic landscape. By examining various economic indicators, individuals can gain a holistic understanding of the factors influencing markets. This knowledge enables them to identify potential opportunities and risks, allowing for more strategic investment decisions.

Benefits of Understanding Trading Economics

- Informed Decision-Making: Access to economic data allows for more accurate predictions and informed investment choices.

- Risk Mitigation: By understanding economic trends, investors can better manage risks and avoid potential pitfalls.

- Strategic Planning: Insights from trading economics help in developing long-term strategies aligned with economic cycles.

Overall, trading economics empowers individuals to navigate the complexities of the financial world with confidence. It provides the tools needed to understand market dynamics and make decisions that align with one's financial goals.

Read also:Khal Drigo The Charismatic Leader And His Enduring Influence

Key Economic Indicators

Economic indicators are vital components of trading economics, as they provide essential data on the health and performance of an economy. These indicators are used by traders, investors, and policymakers to assess economic conditions and predict future trends. Understanding these indicators is crucial for anyone involved in financial markets.

Major Economic Indicators

- Gross Domestic Product (GDP): Measures the total value of goods and services produced within a country, indicating economic growth.

- Inflation Rate: Reflects the rate at which the general level of prices for goods and services is rising, affecting purchasing power.

- Unemployment Rate: Represents the percentage of the labor force that is unemployed and actively seeking employment.

- Consumer Confidence Index: Gauges consumer sentiment towards the economy, influencing spending behavior.

- Interest Rates: Set by central banks, these rates influence borrowing costs and economic activity.

These indicators are essential for understanding the overall economic environment and forecasting potential market movements. By analyzing these metrics, traders can make more informed decisions and develop strategies that align with current economic conditions.

How Do Economic Indicators Affect Markets?

Economic indicators have a significant impact on financial markets, as they provide valuable insights into the state of the economy. These indicators influence investor sentiment, market trends, and overall market behavior. Understanding how these indicators affect markets is crucial for anyone involved in trading economics.

Impact of Economic Indicators

- Market Sentiment: Economic indicators can sway investor confidence, leading to changes in market sentiment and investment behavior.

- Price Movements: Data releases can trigger price fluctuations in stocks, bonds, and currencies, as markets react to new information.

- Monetary Policy: Central banks use economic indicators to guide monetary policy decisions, affecting interest rates and liquidity.

By understanding the relationship between economic indicators and market behavior, traders can anticipate potential market movements and make strategic investment decisions. This knowledge helps to navigate the complexities of financial markets and capitalize on opportunities.

Using Trading Economics for Investment Decisions

Trading economics is an invaluable tool for making informed investment decisions. By analyzing economic data and trends, investors can gain insights into market dynamics and identify potential opportunities. This approach helps to minimize risks and maximize returns, making trading economics an essential component of any investment strategy.

Integrating Trading Economics into Investment Strategies

- Data Analysis: Utilize economic indicators to assess market conditions and identify potential investment opportunities.

- Risk Assessment: Evaluate economic trends to determine potential risks and develop strategies to mitigate them.

- Portfolio Diversification: Use insights from trading economics to diversify investments and reduce exposure to market volatility.

By incorporating trading economics into investment strategies, individuals can make more informed decisions that align with their financial goals. This approach provides a comprehensive understanding of market dynamics, enabling investors to navigate the complexities of the financial world with confidence.

The Role of Technology in Trading Economics

Technology has revolutionized the field of trading economics, providing new tools and platforms for analyzing economic data and making informed decisions. With advancements in technology, traders and investors can access real-time data, automate trading processes, and utilize sophisticated algorithms to enhance their strategies.

Technological Advancements in Trading Economics

- Data Analytics: Advanced analytics tools allow for the processing and interpretation of large volumes of economic data.

- Automated Trading: Algorithms and AI-driven platforms enable automated trading based on predefined economic indicators.

- Real-Time Access: Technology provides real-time access to economic data and market trends, facilitating timely decision-making.

These technological advancements have transformed the field of trading economics, making it more accessible and efficient. By leveraging technology, traders and investors can enhance their strategies and gain a competitive edge in the financial markets.

Common Mistakes in Trading Economics

While trading economics offers valuable insights into market dynamics, it is not without its challenges. Many traders and investors make common mistakes that can hinder their success. Understanding these pitfalls is essential for anyone looking to navigate the complexities of trading economics effectively.

Common Pitfalls in Trading Economics

- Overreliance on Indicators: Relying solely on economic indicators without considering other factors can lead to inaccurate predictions.

- Ignoring Global Events: Failing to account for geopolitical events and global trends can result in missed opportunities and increased risks.

- Lack of Diversification: Not diversifying investments based on economic insights can expose traders to unnecessary risks.

By understanding and avoiding these common mistakes, traders and investors can enhance their trading economics strategies and improve their chances of success in the financial markets.

Trading Economics Strategies

Developing effective strategies is crucial for success in trading economics. These strategies involve analyzing economic data, identifying trends, and making informed decisions based on market conditions. By implementing well-defined strategies, traders and investors can capitalize on opportunities and achieve their financial goals.

Effective Trading Economics Strategies

- Trend Analysis: Use economic indicators to identify market trends and develop strategies that align with those trends.

- Data-Driven Decisions: Base investment decisions on comprehensive data analysis and economic insights.

- Risk Management: Implement risk management strategies to mitigate potential losses and protect investments.

By adopting these strategies, traders and investors can navigate the complexities of trading economics with confidence and achieve successful outcomes in the financial markets.

How to Get Started with Trading Economics?

Embarking on a journey into trading economics can be both exciting and challenging. For those new to the field, understanding where to start is essential. By following a few key steps, individuals can begin to develop the skills and knowledge needed to succeed in trading economics.

Steps to Get Started with Trading Economics

- Educate Yourself: Familiarize yourself with the basics of trading economics and key economic indicators.

- Access Reliable Data: Utilize reputable sources for economic data and analysis to inform your decisions.

- Develop a Strategy: Create a well-defined strategy based on your financial goals and risk tolerance.

- Start Small: Begin with small investments and gradually increase your portfolio as you gain experience.

- Seek Professional Advice: Consult with financial advisors or experts to enhance your understanding and strategies.

By following these steps, individuals can build a strong foundation in trading economics and begin their journey toward financial success.

Understanding Global Economic Cycles

Global economic cycles are essential to trading economics, as they provide insights into the larger patterns of economic growth and contraction. By understanding these cycles, traders and investors can make informed decisions that align with the current phase of the economic cycle.

Phases of Global Economic Cycles

- Expansion: Characterized by economic growth, increased production, and rising consumer confidence.

- Peak: The highest point of economic activity before a downturn, marked by high employment and inflation.

- Contraction: A period of economic decline, reduced production, and increased unemployment.

- Trough: The lowest point of the economic cycle before recovery begins, often marked by low inflation and interest rates.

Understanding these phases allows traders and investors to adjust their strategies based on the current economic environment and capitalize on opportunities as they arise.

Trading Economics and Risk Management

Risk management is a critical component of trading economics, as it helps to protect investments and mitigate potential losses. By understanding the risks associated with economic trends and market dynamics, traders and investors can implement strategies to safeguard their portfolios.

Key Risk Management Strategies

- Portfolio Diversification: Spread investments across different asset classes and sectors to reduce exposure to market volatility.

- Stop-Loss Orders: Implement stop-loss orders to limit potential losses and protect investments.

- Hedging: Use hedging techniques to offset potential losses and manage risks effectively.

By incorporating these risk management strategies into their trading economics approach, individuals can enhance their chances of success and achieve their financial goals.

How Does Trading Economics Influence Policy Making?

Trading economics plays a significant role in shaping policy decisions, as it provides valuable insights into the state of the economy and potential future trends. Policymakers rely on economic data to make informed decisions that impact fiscal and monetary policy, affecting economic growth and stability.

Impact of Trading Economics on Policy Making

- Fiscal Policy: Government spending and taxation decisions are influenced by economic indicators and trends.

- Monetary Policy: Central banks use economic data to set interest rates and control money supply.

- Regulatory Decisions: Economic insights inform regulatory policies and initiatives to promote economic stability.

By understanding the influence of trading economics on policy making, individuals can gain insights into potential policy changes and their impact on financial markets.

Impact of Geopolitical Events on Trading Economics

Geopolitical events can have a profound impact on trading economics, as they influence market dynamics and economic conditions. These events, such as political instability, trade disputes, and international conflicts, can lead to market volatility and affect economic indicators.

Effects of Geopolitical Events

- Market Volatility: Geopolitical events can trigger market fluctuations and increase uncertainty.

- Trade Relations: Political tensions can affect trade agreements and economic partnerships.

- Investor Sentiment: Geopolitical instability can impact investor confidence and risk appetite.

By understanding the impact of geopolitical events on trading economics, traders and investors can develop strategies to navigate market volatility and capitalize on opportunities.

Trading Economics and the Future

The future of trading economics is shaped by technological advancements, evolving market dynamics, and changing economic conditions. As the global economy continues to evolve, traders and investors must stay informed and adapt their strategies to remain competitive.

Trends Shaping the Future of Trading Economics

- Technological Innovation: Advancements in technology will continue to transform data analysis and trading strategies.

- Sustainable Investing: Growing focus on environmental, social, and governance (ESG) factors will influence investment decisions.

- Globalization: Increasing interconnectedness of economies will impact market dynamics and economic trends.

By staying informed about these trends, traders and investors can position themselves for success in the ever-changing world of trading economics.

Frequently Asked Questions

1. What is the primary focus of trading economics?

Trading economics primarily focuses on analyzing economic data and indicators to understand their impact on financial markets and make informed investment decisions.

2. How do economic indicators affect market behavior?

Economic indicators influence market behavior by affecting investor sentiment, triggering price movements, and guiding monetary policy decisions.

3. What role does technology play in trading economics?

Technology plays a crucial role in trading economics by providing advanced tools for data analysis, real-time access to economic data, and automated trading platforms.

4. How can I get started with trading economics?

To get started with trading economics, educate yourself on economic indicators, access reliable data, develop a strategy, start small, and seek professional advice.

5. What are the common mistakes in trading economics?

Common mistakes in trading economics include overreliance on indicators, ignoring global events, and lack of diversification.

6. How does trading economics influence policy making?

Trading economics influences policy making by providing insights into economic conditions, guiding fiscal and monetary policy decisions, and informing regulatory initiatives.

Conclusion

Mastering trading economics is essential for anyone looking to succeed in the financial world. By understanding the core elements of trading economics, individuals can gain valuable insights into market dynamics and make informed decisions that align with their financial goals. Whether you're an investor, trader, or policymaker, trading economics provides the tools needed to navigate the complexities of the global economy and achieve financial success.

As the world of trading economics continues to evolve, staying informed and adapting to new trends and technologies is crucial. By leveraging the power of trading economics, individuals can enhance their financial literacy, develop effective strategies, and capitalize on opportunities in the ever-changing financial markets.

Article Recommendations