Everything You Need To Know About The Zelle App: Features, Benefits, And FAQs

The Zelle app has revolutionized the way people send and receive money, making peer-to-peer (P2P) payments faster, easier, and more secure. With its seamless integration into major banking systems, Zelle has quickly become a favorite for millions of users who value convenience and reliability. Whether you're splitting a dinner bill, paying rent, or sending money to family members, the Zelle app ensures your funds transfer almost instantly, simplifying financial transactions for everyone.

As digital payment solutions continue to evolve, the Zelle app stands out for its simplicity and widespread adoption. Unlike other payment platforms, Zelle is directly connected to your bank account, eliminating the need for additional wallet apps or prepaid balances. This direct connectivity not only speeds up the transfer process but also reduces security risks, making it a trusted choice for personal and business transactions alike. For those who value efficiency and security, the Zelle app offers a perfect blend of both.

In this comprehensive guide, we’ll delve deep into the features, benefits, and usage of the Zelle app, answering common questions and providing tips to maximize its potential. Whether you're a seasoned user or considering trying it for the first time, this article will equip you with all the information you need to make the most of the Zelle app. Let’s explore everything from setup to troubleshooting, and learn why this app has become a cornerstone of digital payments.

Read also:Ultimate Guide To The Chargers Game Everything You Need To Know

Table of Contents

- What is the Zelle App?

- How Does the Zelle App Work?

- Step-by-Step Guide to Using the Zelle App

- Why Choose the Zelle App?

- What Are the Key Features of the Zelle App?

- Is the Zelle App Secure?

- How to Set Up the Zelle App on Your Device?

- How Does the Zelle App Compare to Other Payment Apps?

- Common Issues with the Zelle App and How to Solve Them

- Can Businesses Use the Zelle App?

- What Banks Partner with the Zelle App?

- How to Protect Yourself from Scams on the Zelle App?

- Tips for Maximizing the Zelle App

- FAQs About the Zelle App

- Conclusion

What is the Zelle App?

The Zelle app is a peer-to-peer (P2P) payment platform that allows users to send and receive money quickly and securely. Designed to integrate seamlessly with major banks, Zelle eliminates the need for third-party wallets or prepaid balances. By directly linking to your existing bank account, the app provides instant transfers between users, making it ideal for personal and professional transactions alike.

Launched in 2017 by Early Warning Services, a company owned by several major U.S. banks, Zelle was created to compete with other money transfer services like Venmo and PayPal. Its key differentiator is its close integration with banking systems, which ensures rapid processing times and enhanced security. As of today, Zelle is supported by over 1,500 banks and credit unions, making it one of the most widely used payment platforms in the United States.

Key Benefits of the Zelle App

- Speed: Transfers typically occur within minutes, provided both sender and receiver are enrolled with Zelle.

- Convenience: No need to download additional apps if your bank already supports Zelle.

- Security: Backed by robust banking protocols, Zelle ensures your transactions are protected.

How Does Zelle Differ from Other Payment Services?

Unlike payment apps that require a separate wallet or prepaid balance, the Zelle app works directly with your bank account. This eliminates the hassle of transferring funds between accounts and ensures that your money is always accessible. Additionally, Zelle's instant transfer feature is a significant advantage over services that may take hours or days to process transactions.

How Does the Zelle App Work?

The Zelle app operates by linking your bank account to its payment network. Once enrolled, you can send or receive money using just an email address or mobile phone number. Recipients don’t even need to have the Zelle app; as long as their bank supports Zelle, they can receive the funds directly into their bank account.

Step-by-Step Process

- Sign up for Zelle through your bank’s mobile app or directly via the Zelle app.

- Link your bank account using your email address or phone number.

- Start sending or receiving money by choosing a recipient and entering the desired amount.

- Funds are transferred almost instantly, provided the recipient is also enrolled with Zelle.

Is Enrollment Mandatory?

Yes, both the sender and recipient must be enrolled with Zelle to complete a transaction. However, enrollment is straightforward and can be done through participating banks or the standalone Zelle app.

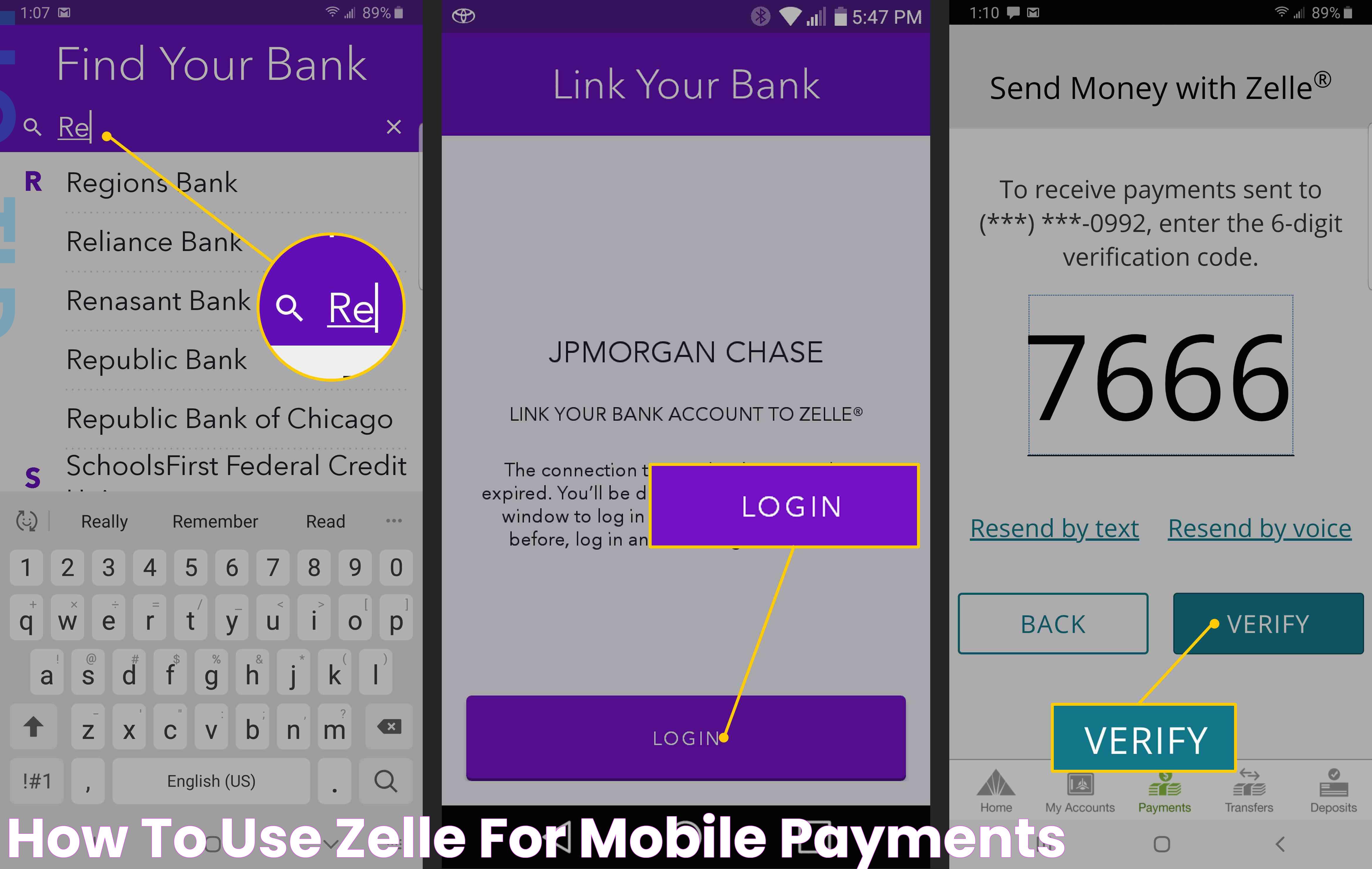

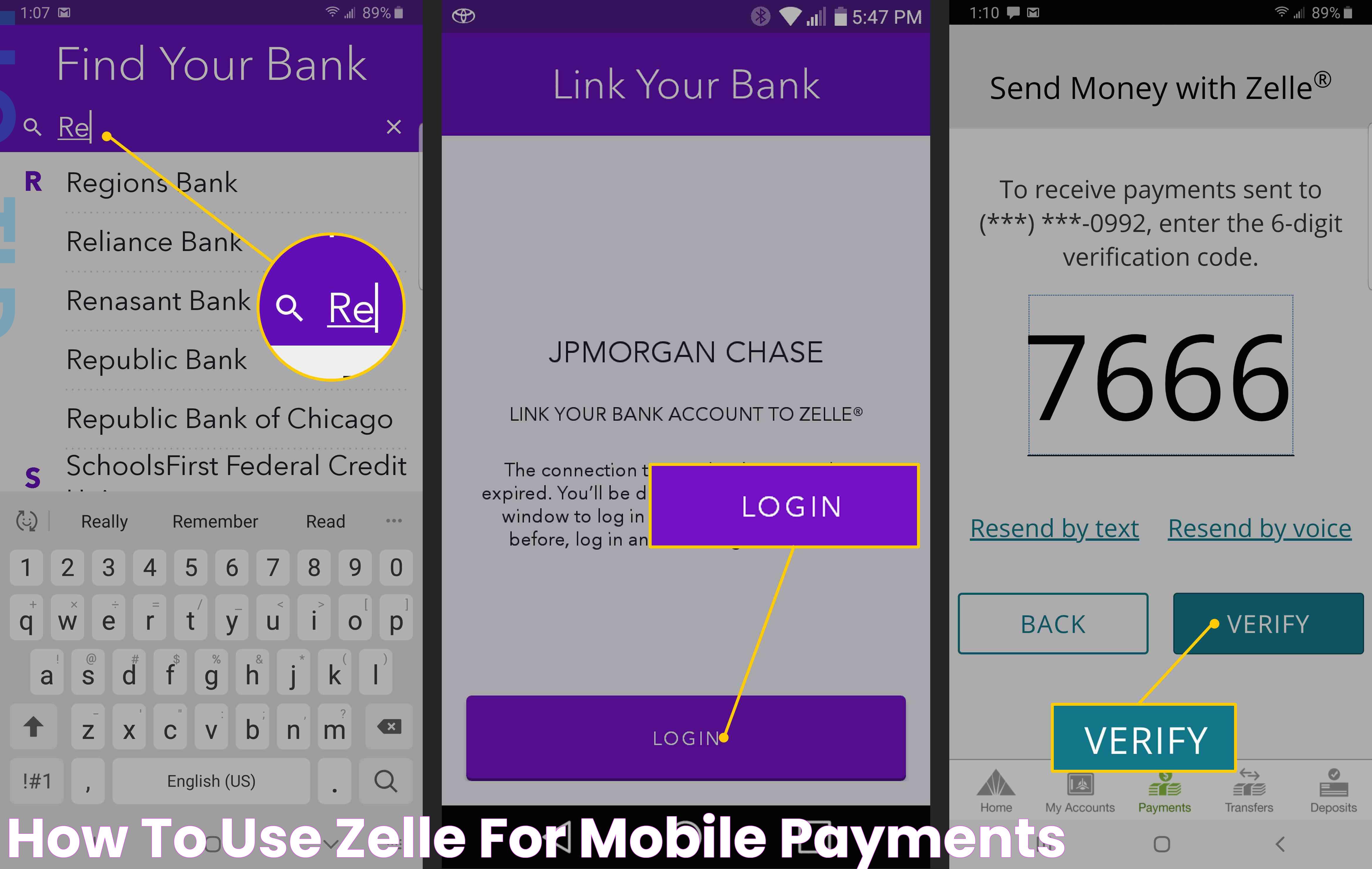

Step-by-Step Guide to Using the Zelle App

Here’s a detailed guide to get you started with the Zelle app, from downloading it to making your first transaction:

Read also:How To Contact Amazon Support Number For Quick Assistance

1. Download and Install the App

- Visit the Apple App Store or Google Play Store.

- Search for "Zelle" and download the app.

- Follow the on-screen instructions to install it on your device.

2. Link Your Bank Account

- Open the Zelle app and sign up using your email or phone number.

- Link your bank account by entering your banking credentials.

- Verify your account through a confirmation email or text message.

3. Begin Sending and Receiving Money

Once your account is set up, you can start using the Zelle app to send and receive money. Simply select a recipient, enter the amount, and confirm the transaction. The funds will transfer almost instantly.

4. Monitor Transactions

Keep track of your payment history within the Zelle app. This feature helps you stay organized and ensures that all transactions are accounted for.

Why Choose the Zelle App?

The Zelle app stands out among digital payment platforms for its speed, ease of use, and integration with banking systems. Let’s explore the reasons why millions of users prefer Zelle:

Advantages Over Other Apps

- No Fees: Unlike some competitors, Zelle does not charge transaction fees for personal transfers.

- Bank Integration: Direct connection to your bank account simplifies the user experience.

- Instant Transfers: Funds are available within minutes, making it ideal for emergencies or time-sensitive payments.

Who Can Benefit the Most?

From splitting rent with roommates to reimbursing friends for dinner, the Zelle app is perfect for anyone who values quick and hassle-free payments. Additionally, small businesses can leverage Zelle to receive payments without incurring high processing fees.

Article Recommendations