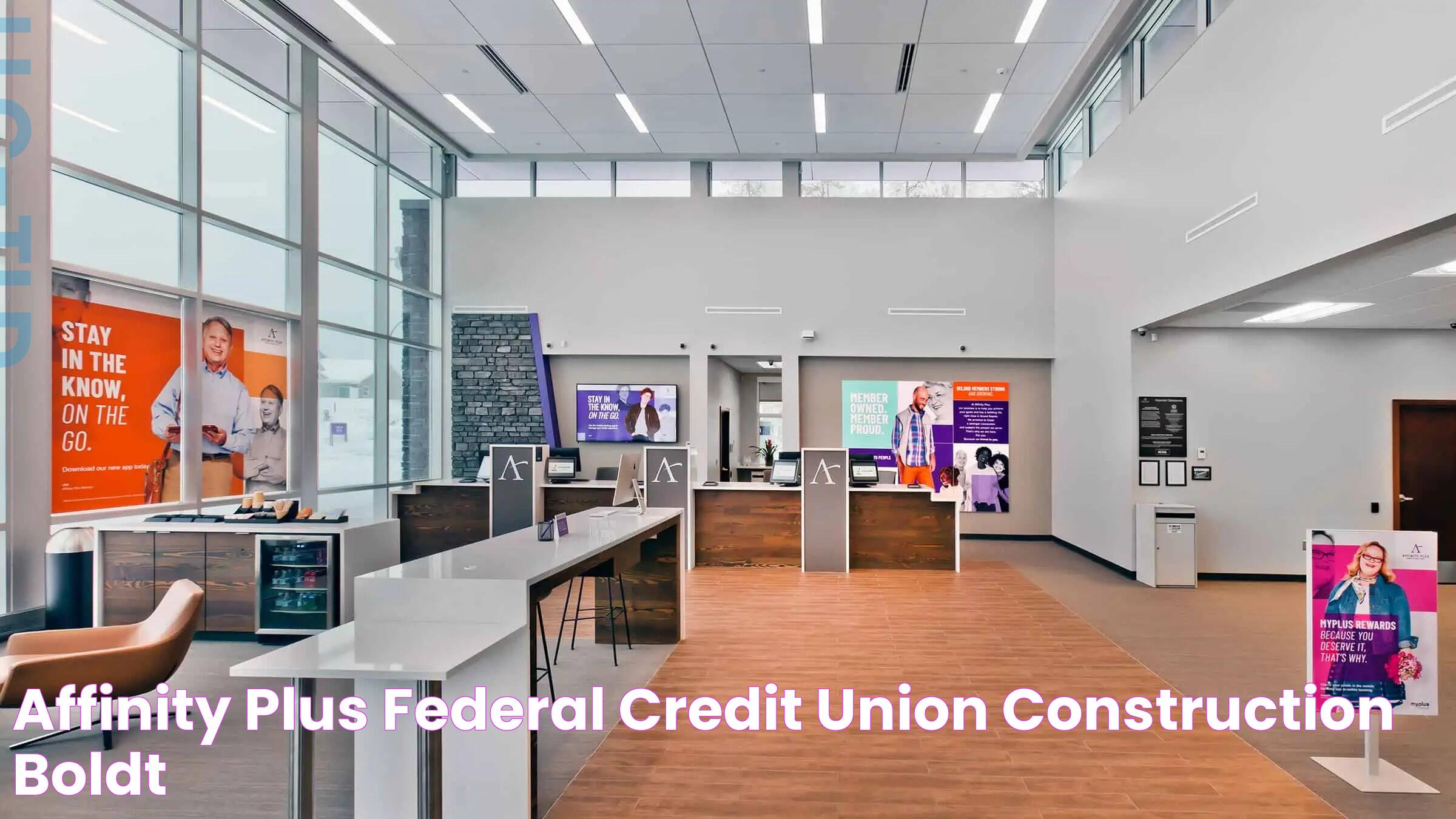

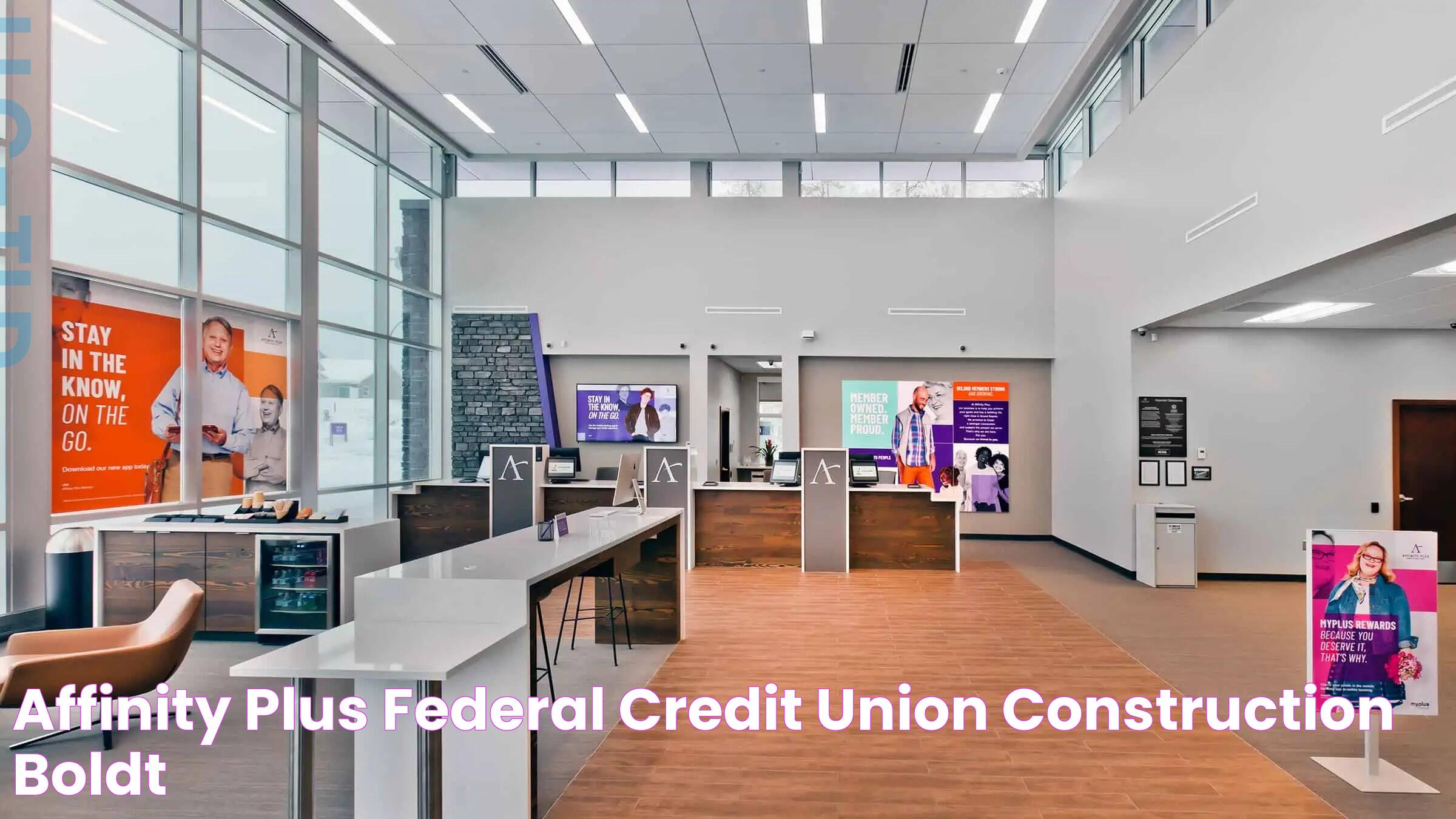

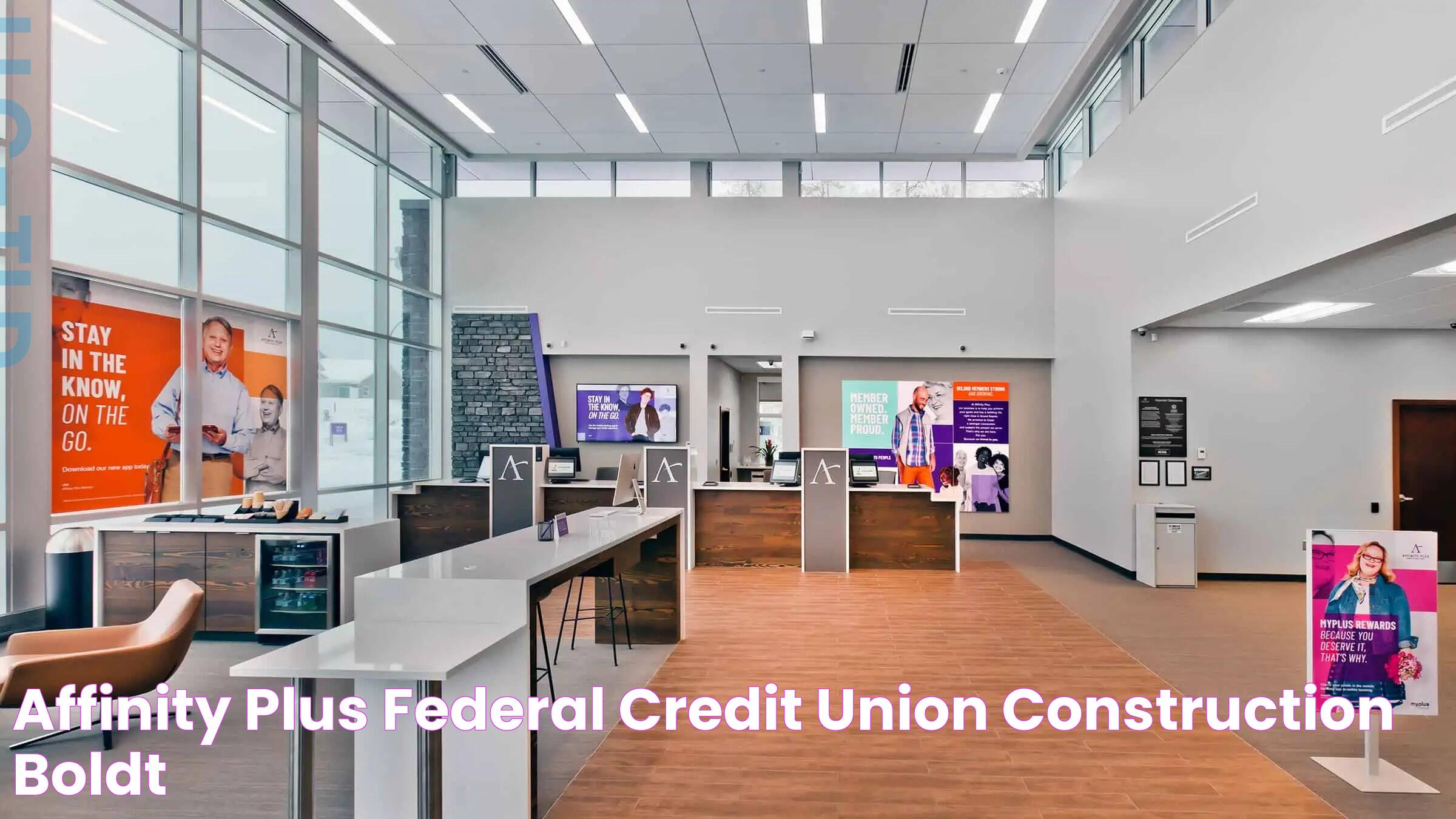

Discovering The Benefits And Services Of A Plus Federal Credit Union

When considering financial institutions that cater to individual needs and community-focused services, A Plus Federal Credit Union stands out as a prime choice. This credit union, known for its member-centric approach, offers a diverse range of financial services that are tailored to improve the financial well-being of its members. Whether you're looking for low-interest loans, savings accounts, or financial education resources, A Plus Federal Credit Union provides comprehensive solutions that make banking accessible and beneficial for everyone involved.

Founded with the mission of providing exceptional financial services to its members, A Plus Federal Credit Union has consistently prioritized member satisfaction and financial growth. Their commitment to maintaining transparency and building trust with their members has been a cornerstone of their operations. As a member-owned cooperative, A Plus Federal Credit Union reinvests its profits back into the services and products it offers, ensuring that members receive the best possible financial advantages.

In this article, we'll delve into the various offerings of A Plus Federal Credit Union, exploring how their services stand out from traditional banking institutions. We'll examine the advantages of becoming a member, the variety of products available, and the community involvement initiatives that reinforce their dedication to member satisfaction. By the end, you'll have a comprehensive understanding of why A Plus Federal Credit Union is a trusted partner for your financial journey.

Read also:Charleston White A Dynamic And Controversial Figure In Modern Society

Table of Contents

- History and Background

- How to Become a Member?

- Financial Products Offered

- What Loan Options Are Available?

- Savings and Investment Opportunities

- Credit Card Benefits

- Exploring Digital Banking Features

- Importance of Financial Education

- Community Involvement and Initiatives

- Customer Service Excellence

- Security Measures and Assurance

- What Do Members Say?

- Frequently Asked Questions

- Conclusion

History and Background

A Plus Federal Credit Union was established with a vision to provide quality financial services to its members. It has a rich history rooted in community service and member satisfaction. Initially founded to serve educators, the credit union has expanded its membership base to include a diverse group of individuals and organizations, reflecting its commitment to inclusivity and accessibility.

The credit union has grown significantly over the years, embracing technological advancements and expanding its service offerings to meet the demands of a changing financial landscape. With a focus on innovation and member-centric services, A Plus Federal Credit Union has established itself as a leader in the financial services industry.

How to Become a Member?

Joining A Plus Federal Credit Union is a straightforward process that opens up a world of financial opportunities. Membership is open to individuals who live, work, worship, or attend school in certain areas, as well as employees of select organizations. Additionally, family members of existing members are eligible to join.

To become a member, you need to open a share savings account with a nominal initial deposit. This account establishes your membership and gives you access to the wide range of products and services offered by the credit union. The membership process is designed to be simple and inclusive, ensuring that everyone has the opportunity to benefit from the credit union's offerings.

Financial Products Offered

A Plus Federal Credit Union offers a variety of financial products tailored to meet the diverse needs of its members. These products include savings accounts, checking accounts, certificates of deposit, and individual retirement accounts (IRAs). Each product is designed to provide competitive rates and flexible terms, allowing members to achieve their financial goals effectively.

In addition to traditional banking products, the credit union also offers specialized services such as auto loans, home mortgages, personal loans, and student loans. These products are competitively priced and come with the added benefit of personalized service and support from knowledgeable credit union staff.

Read also:Introduction To Maplestar Jujutsukaisen And Its Intriguing World

What Loan Options Are Available?

A Plus Federal Credit Union offers a comprehensive range of loan products designed to meet the diverse needs of its members. These include:

- Auto Loans: Competitive rates and flexible terms to finance new or used vehicles.

- Home Mortgages: Various mortgage options with competitive rates for first-time homebuyers and those looking to refinance.

- Personal Loans: Unsecured loans for any purpose, offering fixed rates and flexible repayment terms.

- Student Loans: Financing options for college expenses, with favorable terms and repayment options.

The credit union's loan products are designed to be accessible and member-friendly, with a focus on helping members achieve their financial goals.

Savings and Investment Opportunities

A Plus Federal Credit Union provides a variety of savings and investment options to help members grow their wealth and secure their financial future. These options include:

- Share Savings Accounts: Basic savings accounts with competitive interest rates.

- Certificates of Deposit (CDs): Fixed-term savings products offering higher interest rates for longer investment periods.

- Individual Retirement Accounts (IRAs): Tax-advantaged retirement savings options to help members plan for the future.

- Money Market Accounts: Accounts offering higher interest rates with limited check-writing capabilities.

These savings and investment products are designed to provide members with a range of options to suit their financial needs and goals.

Credit Card Benefits

A Plus Federal Credit Union offers credit card products that provide members with flexibility, convenience, and rewards. The credit union's credit cards come with competitive interest rates, low fees, and a range of benefits, including:

- Rewards Programs: Earn points for every dollar spent, redeemable for travel, merchandise, and more.

- Low Introductory Rates: Enjoy lower interest rates for an introductory period on new purchases and balance transfers.

- Extended Warranties: Additional protection on purchases made with the credit card.

- Fraud Protection: Safeguards against unauthorized transactions and identity theft.

The credit union's credit card products are designed to provide members with valuable benefits while maintaining a focus on affordability and security.

Exploring Digital Banking Features

A Plus Federal Credit Union offers a robust digital banking platform that provides members with convenient access to their accounts anytime, anywhere. The platform features include:

- Online Banking: Access to account balances, transaction history, and online bill payment.

- Mobile Banking App: A user-friendly app for managing accounts on the go, with features like mobile check deposit and funds transfer.

- eStatements: Access to electronic statements for easy account management and reduced paper clutter.

- Alerts and Notifications: Customizable alerts for account activity, helping members stay informed and secure.

The credit union's digital banking services are designed to provide members with a seamless and secure banking experience, enhancing accessibility and convenience.

Importance of Financial Education

A Plus Federal Credit Union is committed to promoting financial literacy and empowering its members to make informed financial decisions. The credit union offers a variety of financial education resources, including:

- Workshops and Seminars: Educational events covering topics like budgeting, saving, and credit management.

- Online Resources: Access to articles, videos, and tools designed to enhance financial knowledge and skills.

- One-on-One Counseling: Personalized financial counseling sessions to help members address specific financial challenges and goals.

These resources are designed to help members build a strong financial foundation and achieve long-term financial success.

Community Involvement and Initiatives

A Plus Federal Credit Union is deeply committed to giving back to the communities it serves. The credit union supports a variety of community initiatives, including:

- Charitable Donations: Financial contributions to local charities and non-profit organizations.

- Volunteer Programs: Encouraging employees to volunteer their time and skills to support community causes.

- Financial Education Outreach: Providing financial literacy programs in local schools and community centers.

The credit union's community involvement efforts reflect its commitment to being a responsible corporate citizen and making a positive impact in the communities it serves.

Customer Service Excellence

At A Plus Federal Credit Union, exceptional customer service is a top priority. The credit union is dedicated to providing members with personalized service and support, ensuring a positive banking experience. Key aspects of the credit union's customer service include:

- Knowledgeable Staff: Experienced and friendly professionals available to assist members with their financial needs.

- Responsive Service: Prompt and efficient handling of member inquiries and requests.

- Member Feedback: Actively seeking and incorporating member feedback to improve products and services.

The credit union's commitment to customer service excellence is reflected in its high member satisfaction ratings and strong reputation in the industry.

Security Measures and Assurance

Ensuring the security of member information and transactions is a top priority for A Plus Federal Credit Union. The credit union employs a variety of security measures to protect member data, including:

- Data Encryption: Advanced encryption technology to secure online transactions and communications.

- Fraud Detection: Monitoring systems to identify and prevent fraudulent activity.

- Privacy Policies: Strict policies to protect member information and ensure confidentiality.

These security measures provide members with peace of mind knowing that their financial information is protected.

What Do Members Say?

Members of A Plus Federal Credit Union consistently praise the credit union for its exceptional service and commitment to member satisfaction. Testimonials highlight the credit union's friendly staff, competitive rates, and comprehensive product offerings. Members also appreciate the credit union's focus on community involvement and financial education.

These testimonials reflect the positive impact that A Plus Federal Credit Union has on its members and the communities it serves.

Frequently Asked Questions

- What is A Plus Federal Credit Union?

A Plus Federal Credit Union is a member-owned financial cooperative that offers a range of financial services to its members, including savings accounts, loans, and financial education resources.

- How do I become a member of A Plus Federal Credit Union?

Membership is open to individuals who meet certain eligibility criteria, such as living, working, or attending school in designated areas. Joining involves opening a share savings account with an initial deposit.

- What types of loans does A Plus Federal Credit Union offer?

The credit union offers a variety of loan products, including auto loans, home mortgages, personal loans, and student loans, each with competitive rates and flexible terms.

- Does A Plus Federal Credit Union offer financial education resources?

Yes, the credit union provides a range of financial education resources, including workshops, online tools, and one-on-one counseling to help members improve their financial literacy.

- What digital banking services are available?

A Plus Federal Credit Union offers a comprehensive digital banking platform with features such as online banking, a mobile banking app, eStatements, and customizable alerts.

- How does A Plus Federal Credit Union ensure the security of member information?

The credit union employs advanced security measures, including data encryption, fraud detection systems, and strict privacy policies, to protect member information and transactions.

Conclusion

A Plus Federal Credit Union stands as a testament to the power of member-focused financial services. With its diverse range of products, commitment to community involvement, and dedication to financial education, the credit union offers valuable resources and support to its members. Whether you're seeking competitive loan options, savings opportunities, or personalized financial guidance, A Plus Federal Credit Union provides a trusted partnership for your financial journey.

The credit union's emphasis on innovation, security, and customer service excellence ensures that members have access to a reliable and rewarding banking experience. As a member-owned cooperative, A Plus Federal Credit Union prioritizes the well-being and success of its members, reinforcing its role as a leader in the financial services industry.

By choosing A Plus Federal Credit Union, members are not only gaining access to exceptional financial products and services, but they are also joining a community dedicated to mutual support and growth. As a member, you become an integral part of a credit union that values your financial well-being and works tirelessly to help you achieve your goals.

Article Recommendations