Mastering Financial Management: The Concept Of Ut What I Owe

Financial responsibility is a crucial aspect of modern life, and understanding what we owe is fundamental to managing our finances effectively. Ut what i owe is a concept that helps individuals and businesses alike track their financial obligations, ensuring that they meet their commitments in a timely manner. This article will delve into the intricacies of this concept, providing a comprehensive understanding of its importance and application in various financial scenarios.

In today's fast-paced world, it's all too easy to lose track of what we owe to others, whether it's a simple IOU to a friend or a complex loan agreement with a financial institution. The concept of ut what i owe serves as a guiding principle to help us stay on top of our financial commitments, fostering a sense of responsibility and accountability in our personal and professional lives.

By exploring the various facets of ut what i owe, this article aims to equip readers with the knowledge and tools needed to manage their debts effectively. We'll cover everything from the basic principles of financial management to the more intricate details of debt consolidation and repayment strategies, ensuring that you have all the information you need to take control of your financial future.

Read also:Luxury Redefined The Fairmont Grand Del Mar Resort In San Diego

Table of Contents

- What is Ut What I Owe?

- Importance of Financial Management

- How Does Ut What I Owe Work?

- Tracking Your Financial Obligations

- Tools and Technologies for Managing Debts

- Common Mistakes in Financial Management

- Strategies for Effective Management of Debts

- A Case Study on Successful Debt Management

- Impact of Debt Management on Credit Scores

- Legal Aspects of Financial Obligations

- Frequently Asked Questions

- Conclusion

What is Ut What I Owe?

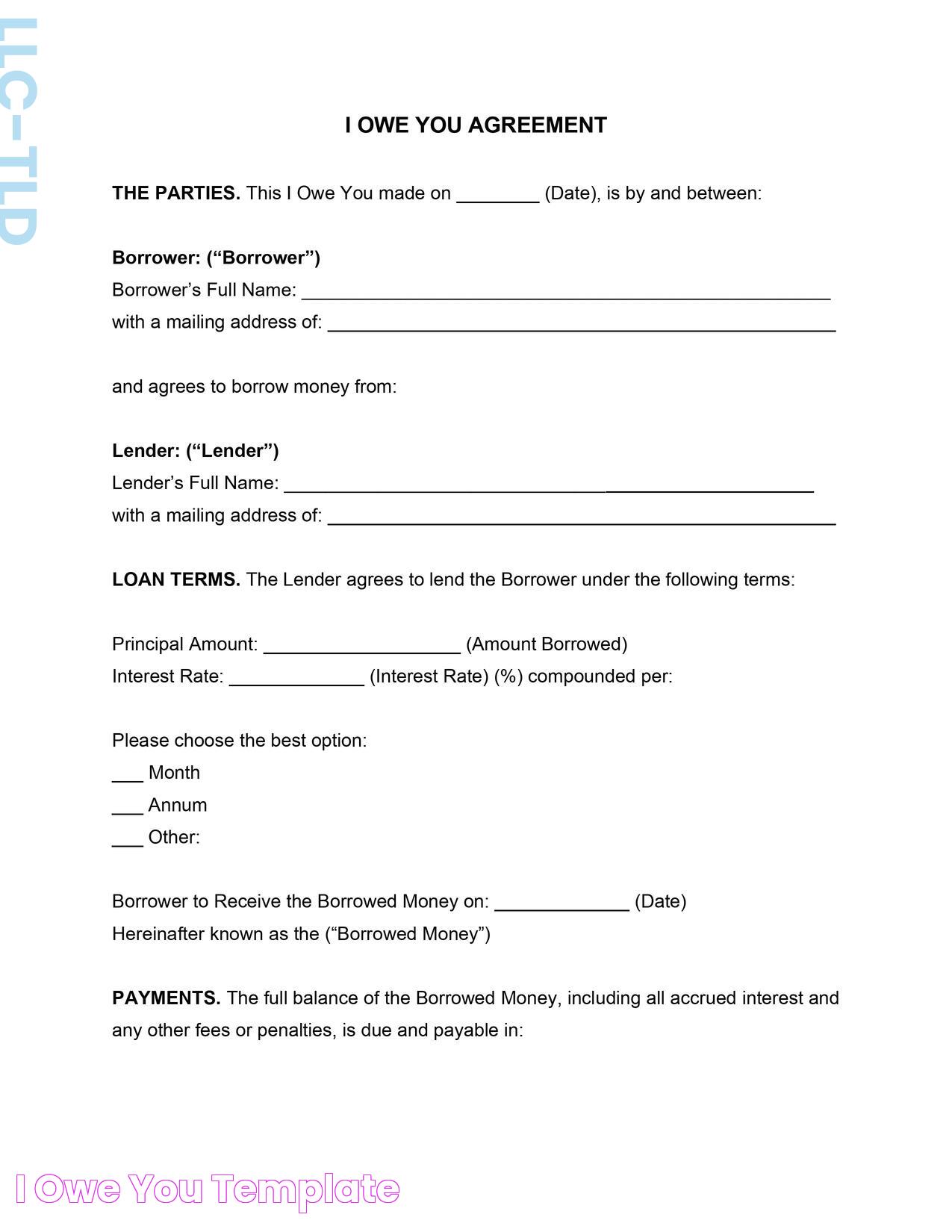

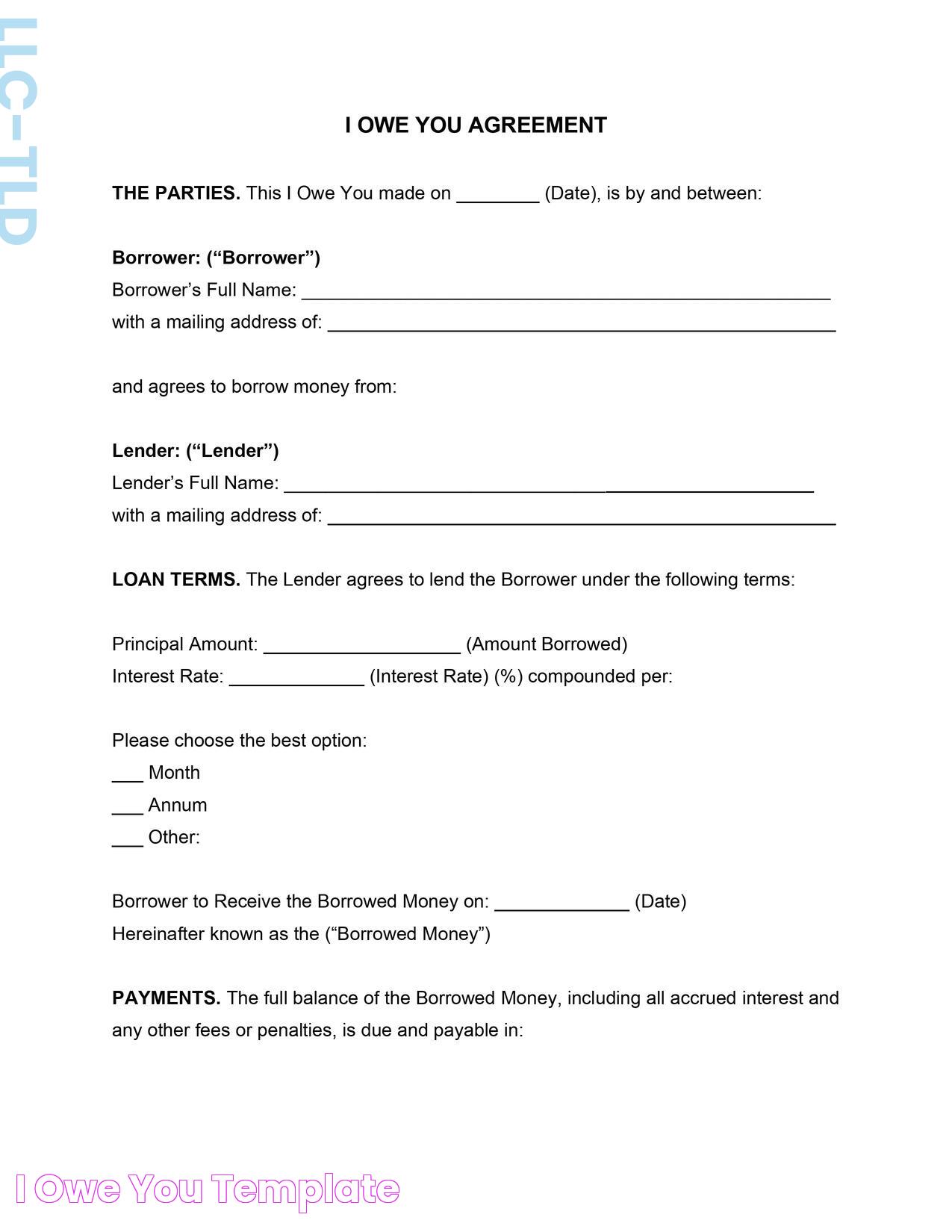

The term "ut what i owe" essentially refers to the concept of being aware of and managing one's financial obligations. It's not just about keeping track of debts, but also understanding the importance of fulfilling these obligations responsibly. In a financial context, it involves maintaining a clear record of what is owed, to whom, and when payments are due.

At its core, the concept emphasizes accountability and transparency in financial dealings. Whether it's personal loans, credit card balances, or business debts, understanding ut what i owe can significantly improve one's financial health and stability. It encourages individuals to prioritize their debts and develop strategies for timely repayment.

Importance of Financial Management

Financial management is crucial for both individuals and businesses. It involves planning, organizing, controlling, and monitoring financial resources to achieve specific financial goals. Effective financial management ensures that resources are used efficiently, debts are paid on time, and financial risks are minimized.

For individuals, good financial management can lead to financial independence, reduced stress, and a more secure future. It enables people to make informed financial decisions, avoid unnecessary debts, and build wealth over time. For businesses, financial management is key to sustaining operations, growing the company, and maximizing shareholder value.

How Does Ut What I Owe Work?

Understanding how ut what i owe works involves recognizing the various components that contribute to one's financial obligations. Typically, these include loans, credit card debts, mortgages, and other liabilities. Each of these obligations comes with its own terms and conditions, such as interest rates, repayment schedules, and penalties for late payments.

To manage these effectively, individuals and businesses must regularly review their financial statements, keep track of due dates, and prioritize repayments based on interest rates and penalties. Developing a budget and sticking to it is also an essential part of managing what is owed. This helps ensure that all financial commitments are met without compromising other financial goals.

Read also:The Future Of Plantbased Eating Impossible Burger Revolution

Tracking Your Financial Obligations

Keeping track of financial obligations is a critical step in managing debts. This involves creating a comprehensive list of all debts, including the amount owed, interest rates, due dates, and minimum payment amounts. By having a clear overview of what is owed, individuals can prioritize repayments and avoid late fees and penalties.

Several tools and strategies can assist in tracking financial obligations effectively. These include spreadsheets, budgeting apps, and financial management software. Regularly updating this information and reviewing it can help individuals stay on top of their debts and make informed financial decisions.

Tools and Technologies for Managing Debts

The advent of technology has made managing debts more accessible and efficient. There are numerous tools and apps available that can help individuals and businesses track their financial obligations, budget effectively, and prioritize repayments. These tools often offer features such as reminders for due dates, automated payment options, and detailed reports on spending patterns.

Some popular tools include budgeting apps like Mint, YNAB (You Need A Budget), and Personal Capital. These apps provide users with a comprehensive overview of their financial situation, helping them make informed decisions about debt management. Additionally, financial management software like QuickBooks and Microsoft Money can be beneficial for businesses in managing their debts and financial obligations.

Common Mistakes in Financial Management

Despite the availability of tools and resources, many individuals and businesses still make common mistakes in financial management. These mistakes can lead to increased debt, financial instability, and even bankruptcy. Some of the most common mistakes include:

- Failing to track expenses and debts accurately.

- Missing payment deadlines due to lack of organization.

- Over-relying on credit cards and incurring high-interest debts.

- Not having an emergency fund to cover unexpected expenses.

- Neglecting to review and adjust budgets regularly.

Avoiding these mistakes requires discipline, organization, and a proactive approach to financial management. By developing good financial habits and using available tools effectively, individuals and businesses can avoid these pitfalls and achieve financial stability.

Strategies for Effective Management of Debts

Effective debt management requires a strategic approach that involves careful planning, organization, and execution. Some strategies that can help individuals and businesses manage their debts more effectively include:

- Creating a comprehensive budget that accounts for all income and expenses.

- Prioritizing debts based on interest rates and penalties.

- Exploring debt consolidation options to reduce interest rates and simplify payments.

- Setting realistic financial goals and working towards them consistently.

- Seeking professional financial advice when necessary.

By implementing these strategies, individuals and businesses can manage their debts more effectively, reduce financial stress, and work towards achieving their financial goals.

A Case Study on Successful Debt Management

To illustrate the effectiveness of debt management strategies, let's consider a case study of a couple, John and Jane, who successfully managed their debts and achieved financial stability. Faced with mounting credit card debts and student loans, John and Jane decided to take control of their financial situation by implementing a comprehensive debt management plan.

They started by creating a detailed budget that accounted for all their income and expenses. They prioritized high-interest debts and focused on paying them off first. They also explored debt consolidation options and managed to secure a lower interest rate on their loans, reducing their monthly payments significantly.

By sticking to their budget and consistently making payments, John and Jane managed to pay off their debts within three years. Their commitment to financial discipline and strategic planning helped them achieve financial stability and work towards their long-term financial goals.

Impact of Debt Management on Credit Scores

Effective debt management can have a positive impact on an individual's credit score. A credit score is a numerical representation of an individual's creditworthiness, based on their credit history and financial behavior. By managing debts responsibly and making timely payments, individuals can improve their credit scores and increase their chances of securing loans at favorable terms in the future.

On the other hand, failing to manage debts effectively can lead to a negative impact on credit scores. Late payments, high credit card balances, and defaults can all contribute to a lower credit score, making it more challenging to secure loans or credit in the future. Therefore, maintaining a good credit score should be a priority for anyone looking to manage their debts effectively.

Legal Aspects of Financial Obligations

Understanding the legal aspects of financial obligations is crucial for effective debt management. Financial agreements, such as loans and credit card contracts, come with specific terms and conditions that must be adhered to. Failure to comply with these terms can result in legal consequences, such as lawsuits, wage garnishments, and asset seizures.

It's essential for individuals and businesses to understand their rights and responsibilities when it comes to financial obligations. Seeking legal advice when necessary and reviewing contracts thoroughly before signing can help prevent legal issues and ensure that financial obligations are met responsibly.

Frequently Asked Questions

What is the best way to keep track of my debts?

Using budgeting apps or financial management software can help you keep track of your debts effectively. These tools provide a comprehensive overview of your financial situation, making it easier to manage your obligations.

How can I improve my credit score?

Improving your credit score involves making timely payments, reducing credit card balances, and avoiding new debts. Regularly reviewing your credit report and disputing any inaccuracies can also help improve your score.

What should I do if I can't meet my financial obligations?

If you're struggling to meet your financial obligations, consider seeking professional financial advice or exploring debt consolidation options. Communicating with creditors and negotiating payment terms can also help alleviate financial stress.

Are there any legal consequences for not paying debts?

Yes, failing to pay debts can result in legal consequences, such as lawsuits, wage garnishments, and asset seizures. It's essential to understand your legal rights and responsibilities when it comes to financial obligations.

How can I prioritize my debts effectively?

Prioritizing debts involves focusing on high-interest debts first and making minimum payments on other obligations. Creating a budget and sticking to it can help you manage your debts more effectively.

What are the benefits of using debt consolidation?

Debt consolidation can simplify your financial situation by combining multiple debts into a single payment with a lower interest rate. This can reduce monthly payments and make it easier to manage your financial obligations.

Conclusion

Understanding and managing ut what i owe is a crucial aspect of financial responsibility. By staying on top of financial obligations, individuals and businesses can achieve financial stability, improve their credit scores, and work towards their long-term financial goals. The strategies and tools outlined in this article provide a comprehensive guide to effective debt management, helping readers take control of their financial future.

Article Recommendations