Essential Guide To Tracking Your NY State Tax Refund Status

Tax season can be a stressful time for many, especially when it comes to anticipating refunds. Understanding your NY state tax refund status can alleviate much of this anxiety by providing clarity and reassurance. Whether you're eagerly awaiting your refund to pay off bills, start a savings account, or simply treat yourself, knowing where your refund stands is crucial. With this guide, we'll delve into the intricacies of the NY state tax refund process, shedding light on key aspects you need to be aware of.

New York State offers various tools and resources to help residents keep track of their tax refund status. However, navigating through these tools might feel overwhelming without a proper understanding of the process. From filing your tax returns correctly to knowing when to expect your refund, there are several steps involved. This comprehensive guide aims to simplify the process, providing detailed insights into each phase of your refund journey.

In this article, we'll explore essential information about checking your NY state tax refund status, including the timeline for refunds, common issues that may delay your refund, and tips for ensuring a smooth refund process. We'll cover frequently asked questions and provide useful resources to assist you along the way. By the end of this article, you'll be well-equipped with the knowledge needed to confidently track your NY state tax refund status.

Read also:Intriguing Lives And Careers Dana Bash And John King

Table of Contents

- Understanding the NY State Tax Refund Process

- How to Check Your NY State Tax Refund Status?

- What Factors Affect Refund Timelines?

- Steps to Ensure a Smooth Tax Refund

- Common Reasons for Refund Delays

- NY State Tax Refund FAQs

- Conclusion

- External Resources for Further Assistance

Understanding the NY State Tax Refund Process

The NY state tax refund process begins once you file your state tax return. After filing, the Department of Taxation and Finance reviews your return to ensure accuracy and compliance with tax laws. This review process is crucial as it determines the legitimacy of the claimed refund. Once your return is validated, the refund process is initiated, which involves either a direct deposit to your bank account or the issuance of a paper check.

The review process involves several checks to prevent fraud and ensure that the refund is being issued to the rightful taxpayer. The department uses advanced systems to verify the information provided in the tax returns. This verification includes checking for discrepancies in income reporting, deductions, and credits claimed. If any inconsistencies are found, the department may reach out to you for further information or clarification.

The time it takes to receive your refund depends on various factors, including how you filed your return (electronically or by paper) and the complexity of your tax situation. Typically, e-filed returns are processed faster than paper returns, with an average processing time of 14 to 21 days. However, if your return is selected for additional review, the processing time might be extended.

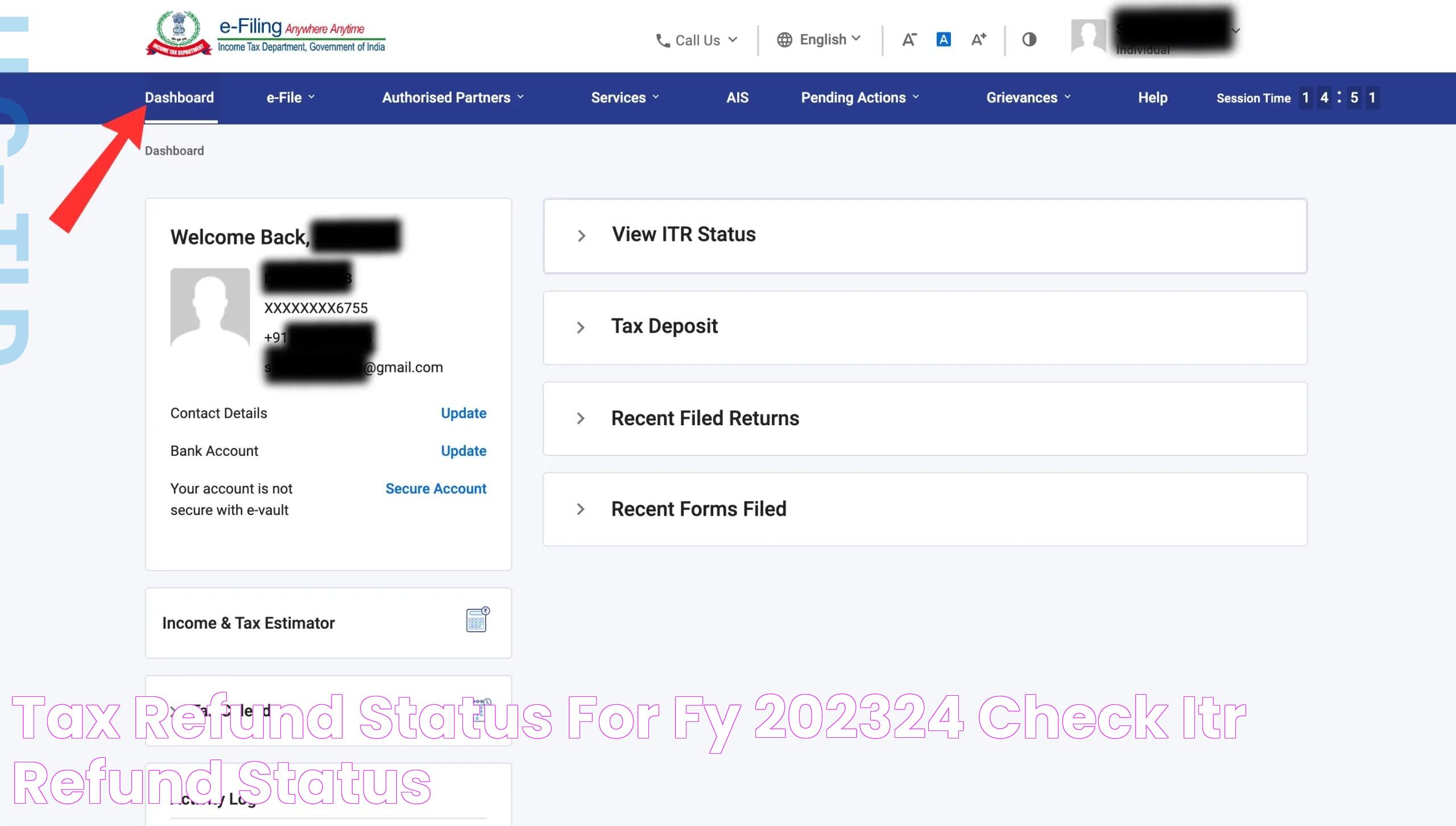

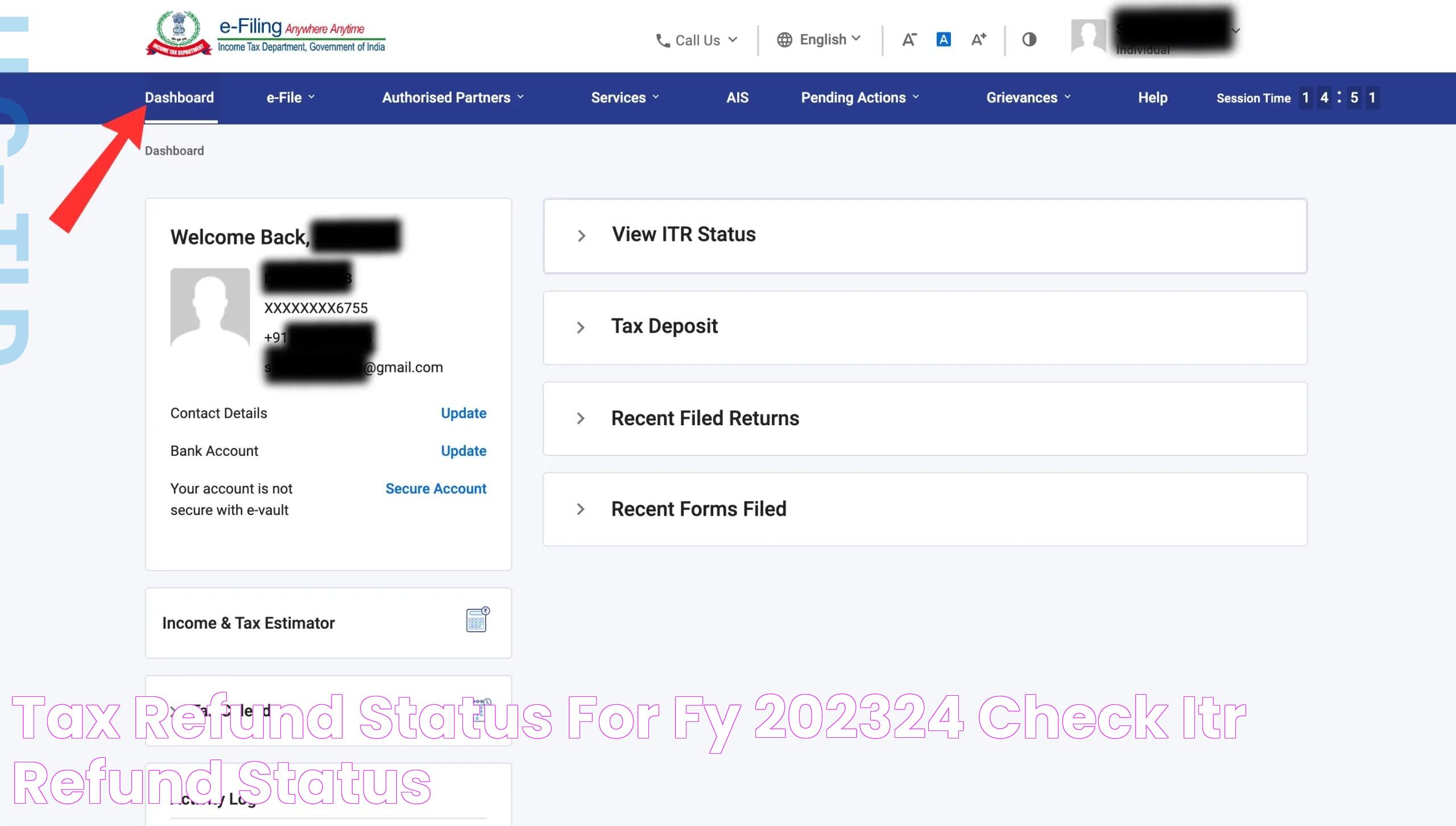

How to Check Your NY State Tax Refund Status?

Checking your NY state tax refund status is a straightforward process, thanks to the online tools provided by the New York State Department of Taxation and Finance. To check your refund status, you'll need your Social Security number, the tax year in question, and the exact amount of your expected refund.

Here's a step-by-step guide to checking your refund status:

- Visit the official New York State Department of Taxation and Finance website.

- Navigate to the 'Check Your Refund' page.

- Enter your Social Security number, the tax year, and the refund amount in the provided fields.

- Click 'Submit' to view the status of your refund.

Once submitted, you'll receive information about your refund status, including whether it's being processed, approved, or if there are any issues that need to be addressed. If you encounter any difficulties or discrepancies, it's advisable to contact the department for assistance.

Read also:Remarkable History And Influence Of Diane Wildenstein

What Factors Affect Refund Timelines?

Several factors can influence the timeline for receiving your NY state tax refund. Understanding these factors can help set realistic expectations and minimize frustration during the waiting period.

Filing Method

As mentioned earlier, the method you use to file your tax return significantly impacts the processing time. E-filing is generally quicker, as it reduces the chances of human error and allows for immediate submission to the tax department's system.

Accuracy of Information

Errors or discrepancies in your tax return can delay the refund process. It's essential to double-check all the information provided in your return, including your Social Security number, income details, and deductions claimed. Ensuring accuracy can expedite the review process and prevent unnecessary delays.

Additional Review

In some cases, your return might be selected for additional review due to various reasons such as high value deductions or credits claimed. This review is a standard procedure to ensure compliance with tax laws and prevent fraud. While this may extend the processing time, it's a necessary step to maintain the integrity of the tax system.

Steps to Ensure a Smooth Tax Refund

To ensure a seamless refund process, consider the following tips:

- File Early: Submitting your tax return early can help avoid the rush and reduce processing times.

- Ensure Accuracy: Double-check all information on your tax return to prevent errors that could delay your refund.

- Opt for Direct Deposit: Choosing direct deposit for your refund speeds up the process compared to receiving a paper check.

- Keep Records: Maintain copies of your filed tax returns and any correspondence with the tax department for reference.

- Respond Promptly: If the tax department requests additional information, respond quickly to avoid further delays.

Common Reasons for Refund Delays

While the NY state tax refund process is generally smooth, there are several common reasons why your refund might be delayed:

Incorrect Information

Providing incorrect personal or financial information on your tax return is one of the most common reasons for refund delays. Ensure that all the details you enter are accurate and up-to-date.

Incomplete Return

Failing to complete your tax return fully or omitting necessary forms can result in the tax department needing additional time to process your refund.

Outstanding Debts

If you have any outstanding state debts, such as unpaid taxes or child support, your refund may be offset to cover these obligations, leading to a delay in receiving the remaining amount.

Identity Verification

As part of fraud prevention measures, the tax department may require additional identity verification before processing your refund. This can include submitting documents to confirm your identity and prevent fraud.

NY State Tax Refund FAQs

1. How long does it usually take to receive a NY state tax refund?

Typically, e-filed returns are processed within 14 to 21 days, while paper returns may take several weeks longer. However, additional reviews or discrepancies may extend these timelines.

2. What should I do if I haven't received my refund within the expected timeframe?

If your refund is delayed beyond the typical timeframe, check your refund status online for updates. If there are issues, contact the New York State Department of Taxation and Finance for assistance.

3. Can I change my refund method after filing my return?

No, once your return is filed, you cannot change the refund method. Ensure you select your preferred method (direct deposit or paper check) when filing.

4. What happens if my refund is offset due to outstanding debts?

If your refund is used to offset debts, you'll receive a notice explaining the offset and the remaining refund amount, if any. Contact the respective agency for more information.

5. How can I avoid refund delays in the future?

To avoid delays, file early, ensure all information is accurate, choose direct deposit, and promptly respond to any correspondence from the tax department.

6. Is there a way to expedite my refund?

There is no official way to expedite your refund. However, filing electronically and choosing direct deposit are the fastest methods to receive your refund.

Conclusion

Navigating the NY state tax refund process can be straightforward with the right information and tools. By understanding the refund process, checking your refund status regularly, and ensuring the accuracy of your tax return, you can minimize delays and receive your refund promptly. Remember that while waiting for your refund can be frustrating, patience and diligence in following up with the tax department can make the process smoother.

External Resources for Further Assistance

For more detailed information and assistance, consider visiting the official New York State Department of Taxation and Finance website. They provide comprehensive resources and contact information for specific inquiries regarding your tax refund status.

Article Recommendations